Automated Parcel Delivery Terminals Market: Transforming Last-Mile Logistics Through Smart, Contactless Delivery Systems

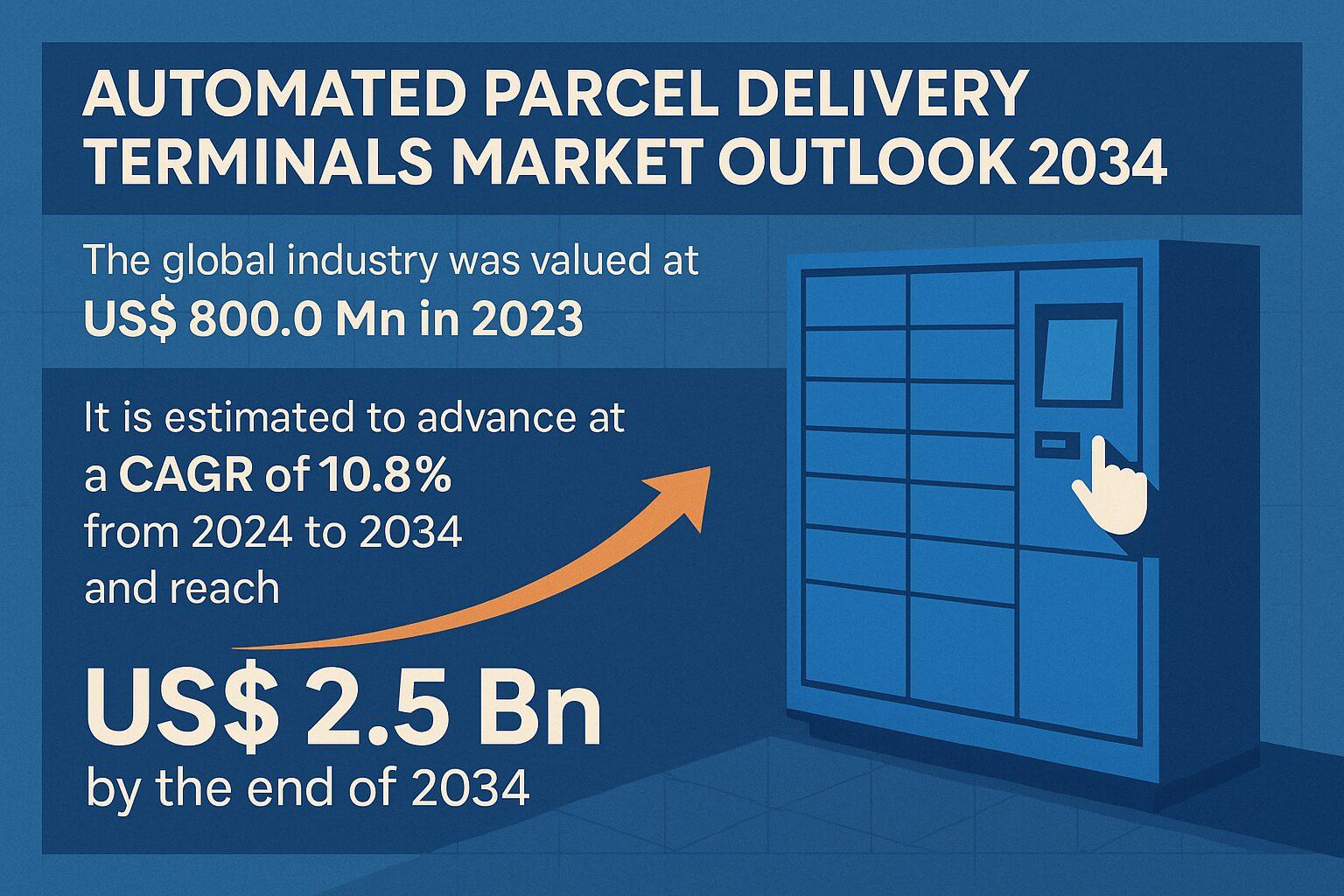

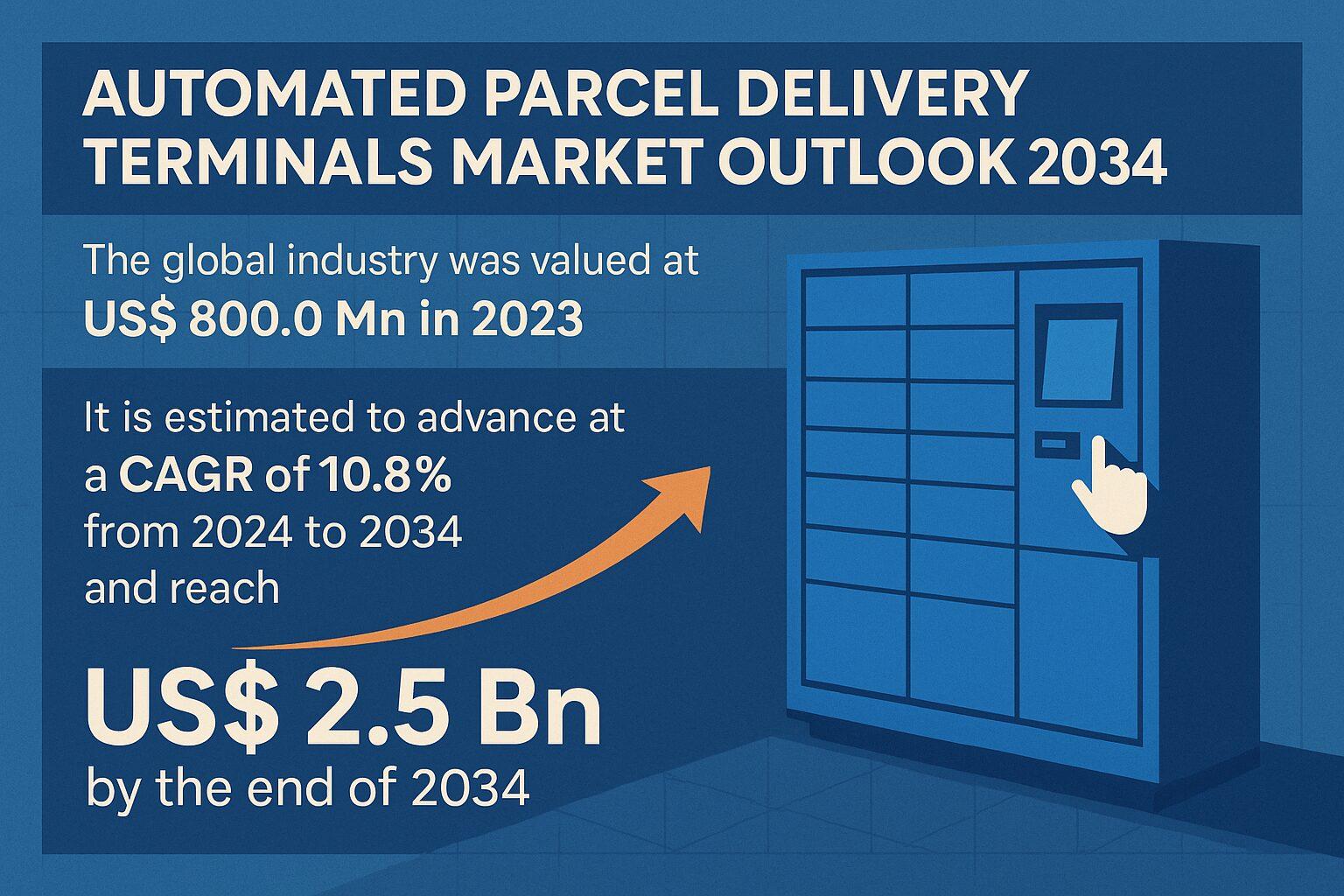

The Automated Parcel Delivery Terminals Market is undergoing rapid transformation as global logistics, e-commerce, retail, and smart-city infrastructure evolve. The rise of digital shopping and the demand for seamless, secure, and flexible parcel handling have turned automated terminals—often referred to as smart lockers or automated parcel stations—into a core component of modern delivery ecosystems. With a value of US$ 800 Mn in 2023, the market is forecast to reach US$ 2.5 Bn by 2034, registering an impressive 10.8% CAGR.

The Automated Parcel Delivery Terminals Market is undergoing rapid transformation as global logistics, e-commerce, retail, and smart-city infrastructure evolve. The rise of digital shopping and the demand for seamless, secure, and flexible parcel handling have turned automated terminals—often referred to as smart lockers or automated parcel stations—into a core component of modern delivery ecosystems. With a value of US$ 800 Mn in 2023, the market is forecast to reach US$ 2.5 Bn by 2034, registering an impressive 10.8% CAGR.

These terminals simplify the complexities of last-mile delivery by enabling customers to collect parcels at their convenience, eliminating missed deliveries and reducing pressure on logistics networks. Their relevance extends across retail chains, logistics providers, residential complexes, government entities, and smart mobility hubs.

This article offers a detailed view of market drivers, segmentation, technological advances, regional insights, competitive dynamics, and future growth trends.

Market Overview

Automated parcel delivery terminals represent a smarter and more secure alternative to traditional doorstep delivery methods. These self-service kiosks allow delivery agents to deposit packages in designated lockers, which customers can access using codes, QR scans, or mobile app authentication. Their appeal lies in their ability to:

-

Offer contactless, hygienic parcel exchanges.

-

Operate 24/7, improving flexibility for users.

-

Reduce operational strain on delivery staff.

-

Enhance last-mile efficiency.

-

Minimize risks associated with theft or misdelivery.

Key locations for the deployment of automated parcel terminals include shopping malls, transport hubs, university campuses, residential buildings, grocery stores, and public walkways. With the growth of online shopping and omnichannel commerce, these terminals have become a crucial part of last-mile delivery strategy for both large corporations and government postal systems.

Key Market Drivers

1. Rising Preference for Contactless Parcel Pickup

Contactless solutions surged in popularity due to rising awareness around hygiene, safety, and convenience. Smart lockers support fully contactless operations—no queues, no human interaction, and no need for residents to be available for delivery.

Key benefits driving adoption include:

-

Enhanced parcel security through tracked and authenticated access.

-

Reduced risk of theft in residential buildings and public areas.

-

Optimized workforce utilization for courier companies.

-

Convenience-driven customer behavior across all age groups.

Telecom providers, retail chains, medical stores, schools, and financial institutions are deploying these terminals to expand their service portfolios and cater to evolving consumer expectations.

2. Expansion of the Global E-Commerce Sector

The e-commerce boom is directly accelerating demand for automated terminals. Online shopping has grown exponentially, leading to soaring parcel volumes and mounting pressure on last-mile delivery. Automated terminals solve several logistical challenges:

a. Elimination of Failed Deliveries

Doorstep delivery faces issues like wrong addresses, unavailable recipients, or access restrictions—leading to delivery delays and higher costs. Smart terminals eradicate these issues.

b. Efficient Reverse Logistics

The surge in online returns makes automated drop-off kiosks invaluable for retailers and logistics firms.

c. Reduced Carbon Footprint

Consolidated deliveries to lockers reduce delivery mileage and fuel consumption.

d. Enhanced Customer Satisfaction

Consumers appreciate the flexibility of choosing when and where to pick up packages.

Countries such as India, China, the U.K., Germany, France, Japan, and the U.S. have witnessed exponential growth in e-commerce, nudging companies to invest heavily in automated parcel networks.

3. Growth in Smart City Initiatives

Many governments are upgrading their public infrastructure to align with smart city standards. Automated parcel delivery terminals fit naturally into this shift by offering:

-

Digitally integrated parcel handling.

-

Reduced reliance on manual labor.

-

Efficient public postal services.

-

Modernized last-mile delivery models.

Postal organizations globally are deploying smart lockers to cut delivery costs and increase accessibility in both urban and semi-urban areas.

4. Increasing Demand for Sustainable Delivery Models

Organizations are aggressively adopting eco-friendly delivery mechanisms. Parcel lockers significantly reduce vehicle usage, CO₂ emissions, and fuel consumption, making them a sustainable solution for high-density delivery zones.

Governments and corporate sustainability policies further reinforce their adoption.

Market Segmentation

A breakdown of the market reveals two major segmentation categories: Deployment Type and Ownership.

1. By Deployment Type

a. Indoor Terminals

-

Installed inside malls, office buildings, hotel lobbies, campuses, railway stations, and supermarkets.

-

Offer higher security and reduced maintenance costs.

-

Preferred in metropolitan regions due to constant foot traffic.

-

Protected from weather, reducing wear and tear.

b. Outdoor Terminals

-

Designed with rugged materials to withstand rain, heat, vandalism, and harsh climates.

-

Installed in open public locations, parking areas, and busy commercial zones.

-

Crucial for areas where indoor space is limited.

-

Enable 24-hour accessibility even in remote regions.

Outdoor terminals are growing particularly fast as cities expand smart logistics infrastructure.

2. By Ownership

a. Retailers

Retailers integrate automated terminals to enhance their omnichannel capabilities. These terminals support:

-

Click-and-collect

-

Buy-online-pick-up-in-store (BOPIS)

-

Easy in-store returns

They reduce store congestion while enhancing customer experience.

b. Shipping and Logistics Companies

Courier and logistics players like DHL, FedEx, and local carriers deploy terminals to optimize delivery operations. Terminals allow multi-package drop-offs, reducing multiple door-to-door visits.

c. Government Organizations

Governments adopt smart lockers for:

-

Postal services

-

Municipal service centers

-

Urban delivery hubs

-

Public sector convenience initiatives

d. Others

Includes:

-

Residential societies

-

Universities

-

Corporate parks

-

Co-living spaces

-

Hospitals

Growing urbanization is driving adoption across these segments.

Regional Market Analysis

1. Europe – The Global Leader

Europe dominated the market in 2023 and continues to lead through 2034. The region’s rapid digital transformation and mature e-commerce ecosystem fuel its leadership.

Reasons for dominance:

-

High user penetration in e-commerce.

-

Strong preference for click-and-collect services.

-

Expansion of Pick-Up Drop-Off (PUDO) points.

-

Rising investment from postal service providers.

-

Sustainability-focused government regulations.

More than 40% of PUDO points in the EU were installed after mid-2019, demonstrating Europe's aggressive infrastructure expansion.

Norway, Germany, and the U.K. exhibit the highest smart locker penetration globally.

2. North America

North America, led by the U.S. and Canada, is experiencing steady growth due to:

-

Dense urban populations requiring smarter delivery solutions.

-

Higher adoption across condos, gated communities, and universities.

-

Strong digitalization in retail and logistics.

-

Innovations by technology companies and start-ups.

Smart lockers are becoming standard features in new residential and commercial developments.

3. Asia Pacific – Fastest Growing Market

Asia Pacific is set to witness the highest growth rate. Key drivers include:

-

Explosive e-commerce adoption.

-

Government investment in digital infrastructure.

-

Rapid urbanization.

-

Increasing demand for fast, secure deliveries.

China leads in automated locker deployment, followed by Japan, South Korea, India, and Singapore.

4. Middle East & Africa

MEA is emerging as a promising region due to smart city initiatives in countries such as the UAE, Saudi Arabia, and Qatar. Public–private partnerships are accelerating locker installations in malls, airports, and metro stations.

5. South America

Brazil dominates due to its rapidly expanding e-commerce sector. Logistics firms are heavily investing in cost-efficient delivery models to meet surging customer demand.

Competitive Landscape

The market features several global and regional players investing heavily in innovation, product portfolio expansion, and network scaling. Major companies include:

-

Quadient

-

Winnsen Industry Co., Ltd.

-

Bell and Howell LLC

-

TZ Limited

-

KEBA

-

ByBox Holdings Limited

-

Cleveron

-

Smartbox Ecommerce Solutions Private Ltd.

-

InPost sp. z o.o.

-

ENGY Company

Key Competitive Strategies

1. Geographic Expansion

Companies are rapidly installing new terminals across strategic high-traffic zones.

2. Technology Modernization

-

AI-driven parcel status tracking

-

Biometric authentication

-

IoT maintenance sensors

-

Cloud-based dashboards

3. Network Partnerships

Logistics firms are collaborating with retail chains, real estate developers, and municipal bodies.

4. Carrier-Agnostic Models

Terminals usable by any courier help maximize utilization and revenue.

Recent Developments

Quadient (March 2024)

Partnered with Stonegate Group, the U.K.’s largest pub operator, to install 400 new smart locker units across 1,200 properties.

Bell and Howell (June 2023)

Installed the BH QuickCollect GO! Pod at a major U.S. grocery chain, strengthening customer convenience for grocery pickup.

Such expansions highlight the global shift toward automated last-mile solutions.

Emerging Trends

1. Integration of AI & Predictive Analytics

AI enhances:

-

Maintenance management

-

Parcel volume prediction

-

Automated customer alerts

-

Security surveillance

2. Drone and Autonomous Delivery Integration

Future lockers may serve as landing or docking points for drones.

3. Eco-Friendly Locker Manufacturing

Manufacturers are using recycled materials and energy-efficient systems.

4. Hyper-Localization

Smaller locker banks strategically placed in high-density neighborhoods enhance delivery speed.

5. Multi-Utility Terminals

Future terminals may offer additional services:

-

Document storage

-

Cold storage for groceries

-

Return processing

-

E-commerce kiosks

Market Challenges

1. High Initial Costs

Installation, integration, and maintenance—especially for outdoor terminals—can be expensive.

2. Software Interoperability Issues

Different carriers use different scanning and tracking systems.

3. Vandalism and Security Risks

Outdoor terminals require advanced security features and durable materials.

4. Slow Adoption in Rural Areas

Economic viability remains low in low-density regions.

Future Market Outlook (2024–2034)

The next decade will accelerate adoption across all regions as e-commerce continues to scale. Technological innovation will bring:

-

Automated replenishment and repair systems.

-

Smart lockers integrated with electric delivery vehicles.

-

City-wide locker networks interconnected via smart mobility grids.

-

New revenue models for retailers and real estate operators.

-

Personalized delivery scheduling powered by AI algorithms.

By 2034, parcel terminals will become an everyday infrastructure component—just like ATMs—across the world’s major cities.

Conclusion

The Automated Parcel Delivery Terminals Market is poised for exceptional growth as consumers, businesses, and governments recognize the value of secure, flexible, and efficient parcel handling. Driven by e-commerce expansion, technological advancements, and sustainability goals, smart lockers are redefining global logistics and shaping the future of last-mile delivery.

- SEO

- Biografi

- Sanat

- Bilim

- Firma

- Teknoloji

- Eğitim

- Film

- Spor

- Yemek

- Oyun

- Botanik

- Sağlık

- Ev

- Finans

- Kariyer

- Tanıtım

- Diğer

- Eğlence

- Otomotiv

- E-Ticaret

- Spor

- Yazılım

- Haber

- Hobi