GCC Luxury Residential Real Estate Market Future Business Opportunities 2025-2030 | MarkNtel

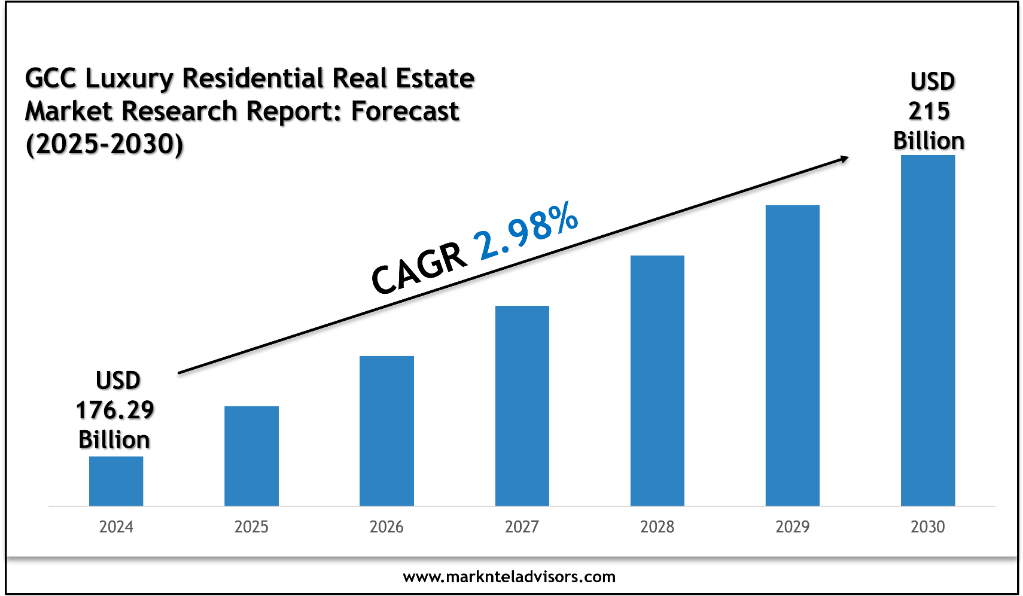

As per MarkNtel The GCC Luxury Residential Real Estate Market size was valued at around USD 176.29 billion in 2024 and is projected to reach USD 215 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 2.98% during the forecast period, i.e., 2025-30.

GCC Luxury Residential Real Estate Market Systems Market Outlook:

The main reason behind this growth is the desire of people to live in luxury homes that have multiple advantages such as large spaces, attractive interiors, and enhanced security along with high-class amenities such as play areas, swimming pools, and much more. All these factors combined provide a high-quality life and also act as a symbol of status for the consumers.

In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecast for years 2026 to 2032, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.

Explore the Insights – Download a Free Sample: https://www.marknteladvisors.com/query/request-sample/gcc-luxury-residential-real-estate-market.html

GCC Luxury Residential Real Estate Market Systems Market Segmentation:

By Type

- Flats & Apartments - Market Size & Forecast 2020-2030, USD Million

- Condominiums - Market Size & Forecast 2020-2030, USD Million

- Penthouses - Market Size & Forecast 2020-2030, USD Million

- Townhouses & Villas - Market Size & Forecast 2020-2030, USD Million

- Others - Market Size & Forecast 2020-2030, USD Million

By Configuration

- 1-2 Bedrooms (BHK) - Market Size & Forecast 2020-2030, USD Million

- 3-4 Bedrooms (BHK) - Market Size & Forecast 2020-2030, USD Million

- 5-6 Bedrooms (BHK) - Market Size & Forecast 2020-2030, USD Million

- 7 & above Bedrooms (BHK) - Market Size & Forecast 2020-2030, USD Million

- By Furnishing

- Fully-Furnished - Market Size & Forecast 2020-2030, USD Million

- Semi-Furnished - Market Size & Forecast 2020-2030, USD Million

By Size

- Less than 5,000 sq. ft. - Market Size & Forecast 2020-2030, USD Million

- 5,000 – 10,000 sq. ft. - Market Size & Forecast 2020-2030, USD Million

- 10,000 – 15,000 sq. ft. - Market Size & Forecast 2020-2030, USD Million

- 15,000 – 20,000 sq. ft. - Market Size & Forecast 2020-2030, USD Million

- Above 20,000 sq. ft. - Market Size & Forecast 2020-2030, USD Million

By Price

- 1 – 5 (USD Millions) - Market Size & Forecast 2020-2030, USD Million

- 5 – 10 (USD Millions) - Market Size & Forecast 2020-2030, USD Million

- 10 – 20 (USD Millions) - Market Size & Forecast 2020-2030, USD Million

- 20 – 50 (USD Millions) - Market Size & Forecast 2020-2030, USD Million

- 50 – 100 (USD Millions) - Market Size & Forecast 2020-2030, USD Million

- Above 100 (USD Millions) - Market Size & Forecast 2020-2030, USD Million

By Region

- The UAE

- Saudi Arabia

- Qatar

- Kuwait

- Oman

- Bahrain

GCC Luxury Residential Real Estate Market Recent Development:

- 2024: Emaar Properties collaborated with Dubai World Trade Centre to develop Expo Living, a community in the Dubai South. In this community, the Emaar properties also launched Terra Heights, luxurious residential apartments.

- 2024: DAMAC Properties introduced DAMAC Sun City, a new luxurious residential property. This development is designed to provide elegance and luxury along with nature-centric living.

Tap into future trends and opportunities shaping the GCC Luxury Residential Real Estate Market complete report: https://www.marknteladvisors.com/research-library/gcc-luxury-residential-real-estate-market.html

GCC Luxury Residential Real Estate Market Drivers:

Tax Benefits Attracting a High Number of Investors – The tax benefits available in this region are the main factors that attract a lot of local and foreign people to invest in luxury properties in this region. There are no taxes involved in buying a property or any yearly charges in the UAE, Qatar, Kuwait, and Oman. In Saudi Arabia and Bahrain, buyers are free from annual taxes, but they have to pay taxes for transferring the properties to themselves. This tax is only around 2% in Bahrain and 5% in Saudi Arabia. As a result, luxury houses have become more attractive and accessible for buyers and investors in this region. For instance, real estate transactions increased by around 13.1% in Sharjah that were worth around USD 7.4 billion in 2023.

Report Highlights Essential Insights for Strategic Decision-Making

- Detailed market size, share, and forecast analysis

• In-depth pricing trends and segment-wise cost evaluations

• Key industry strategies, including innovation, partnerships, and acquisitions

• Critical value chain analysis and stakeholder profiling

• Regional import-export market insights and trade flow assessment

• Thorough competitive benchmarking of top hearing aid manufacturers

• Identification of new growth opportunities and niche market segments

• Overview of market trends, drivers, and challenges shaping future demand

Some of the leading players in the GCC Luxury Residential Real Estate Market are:

- Emaar Properties

- Sobha Realty

- Meraas

- Nakheel Properties

- DAMAC Properties

- Dar Al Arkan

- Jabal Omar Development Company

- Barwa Real Estate

- Wujha Real Estate

- Al Raid Group

- Al Mouj Muscat

- Al Akaria and others.

Report Delivery Format – Market research reports from MarkNtel Advisors are delivered in PDF, Excel, and PowerPoint formats. Once the payment is successfully processed, the report will be sent to your registered email within 24 hours.

Select a License That Matches Your Business Requirements with Instant Offer - https://www.marknteladvisors.com/pricing/gcc-luxury-residential-real-estate-market.html

Research Methodology Summary

A systematic approach is used to ensure accurate market insights, combining both bottom-up and top-down methods. Data triangulation validates findings from multiple angles.

Key Steps:

- Define objectives and research design

- Collect data through surveys and interviews

- Analyze and validate data using reliable tools

- Forecast trends and deliver actionable insights

About us:

MarkNtel Advisors is a globally recognized market research firm offering comprehensive insights into the construction and mining sector, encompassing building management, construction materials, and construction technology & equipment. We assist developers, equipment manufacturers, and infrastructure investors in understanding market trends, sustainability mandates, and technological disruptions. Leveraging our Competitive Intelligence services, we help organizations benchmark competitors, identify white spaces, and craft informed growth strategies for enduring success in the global construction landscape.

Trending blog:

- https://www.prnewswire.com/news-releases/north-america-used-truck-market-to-surpass-usd-24-43-billion-by-2030-fueled-by-fleet-renewal--regulatory-shifts--markntel-advisors-302595305.html

- https://www.prnewswire.com/news-releases/us-snacks-market-to-surpass-usd-193-51-billion-by-2030-driven-by-protein-rich-formulations--ai-powered-personalization--markntel-advisors-302595304.html

Reach Us:

MarkNtel Advisors

H-159, Sector 63, Noida, Uttar Pradesh-201301, India

Contact No: +91 8719999009

Email: sales@marknteladvisors.com

Visit our Website: https://www.marknteladvisors.com

We’re always open to sharing insights, exploring ideas. Follow us to stay updated on the latest news and industry trends.

- SEO

- Biografi

- Sanat

- Bilim

- Firma

- Teknoloji

- Eğitim

- Film

- Spor

- Yemek

- Oyun

- Botanik

- Sağlık

- Ev

- Finans

- Kariyer

- Tanıtım

- Diğer

- Eğlence

- Otomotiv

- E-Ticaret

- Spor

- Yazılım

- Haber

- Hobi