Container Fleet Market: Trends, Challenges, Opportunities & Outlook (2025–2026)

Introduction

The Container Fleet Market underpins global trade, serving as the backbone of maritime logistics and supply chains. As global commerce evolves, so does the container shipping sector—driven by trade diversification, digitalization, sustainability goals, and geopolitical dynamics. The market embraces ongoing digital transformation and environmental regulations while managing capacity growth, fleet expansions, and disruptive global events.

Market Overview

The container fleet market encompasses the world’s container ships, containers, associated services, and logistics networks supporting the transport of standardized shipping containers. It includes dry containers, refrigerated containers (reefers), special-purpose containers, vessels of various sizes, and related technologies for managing and tracking these assets.

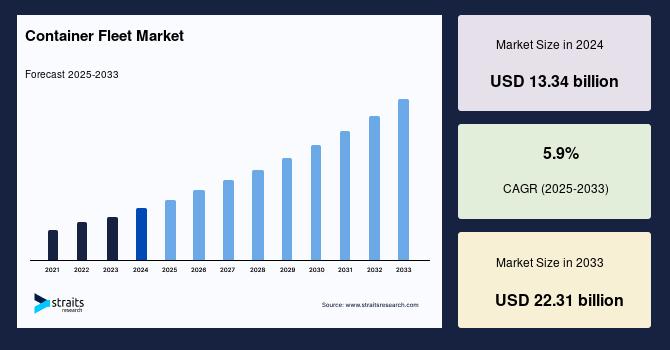

According to industry estimates:

-

The global container fleet market was valued around USD 13.5 billion in 2024 with expectations to grow significantly through the next decade.

-

Forecasts suggest steady demand through 2035 driven by trade growth and fleet modernization.

Get Your Sample Report Here:https://straitsresearch.com/report/container-fleet-market

Buy Report Now:https://straitsresearch.com/report/container-fleet-market/request-sample

Download full report:https://straitsresearch.com/buy-now/container-fleet-market

Segments Covered

-

Container Types

-

Dry Storage Containers

-

Reefer Containers

-

Tank Containers

-

Specialized Containers (e.g., open-top, flat rack)

-

-

Vessel Types

-

Ultra-Large Container Vessels (ULCVs)

-

Panamax & Post-Panamax Ships

-

Feeder and Handy Vessels

-

-

Services & Technology

-

Digital fleet management platforms

-

AI-based tracking and predictive maintenance

-

Real-time container monitoring

-

Latest Trends Shaping the Market

1. Fleet Overcapacity and New Order Surge

The container ship orderbook remains historically high, with tens of millions of TEU scheduled for delivery in the mid‑2020s. Overcapacity is pressuring freight rates and utilization, prompting carriers to optimize operations and pricing strategies.

2. Strategic Alliance Restructuring

Major carriers have reshaped cooperation:

-

Gemini Cooperation between Maersk and Hapag-Lloyd launched in 2025 to pool vessels and improve reliability across key routes.

-

MSC chose independent operations with a massive fleet and extensive orderbook.

3. Sustainability and Alternative Fuels

Green shipping initiatives are gaining momentum:

-

Hapag‑Lloyd and North Sea Container Line (NCL) plan to power ships with low‑emission e‑fuels from 2027.

-

Carriers are ordering LNG, ammonia, and methanol‑ready vessels to cut emissions and meet IMO targets.

4. Digitalization and Smart Fleet Technologies

Implementation of AI‑based fleet optimization and predictive maintenance systems—like Maersk’s partnership with tech firms to reduce fuel and downtime—is becoming mainstream. Real‑time container tracking and smart containers enhance operational efficiency.

5. Regional Growth Focus

Asia‑Pacific leads growth through expanding trade lanes, port infrastructure investments, and container fleet additions to support intra‑regional commerce.

Challenges Facing the Market

1. Supply/Demand Imbalance

New vessel deliveries risk outpacing cargo demand, potentially suppressing freight rates and shrinking carriers’ margins.

2. Operational Constraints

Port bottlenecks, container imbalances, and high repositioning costs challenge efficient fleet use.

3. Rising Costs

Growing container manufacturing and maintenance costs due to raw material volatility and environmental compliance place pressure on profitability.

4. Geopolitical and Security Risks

Trade disruptions—such as attacks on shipping routes in conflict regions—impact throughput and risk insurance costs. For example, intensified attacks on Ukraine’s Black Sea routes have cut container traffic significantly.

5. Regulatory Compliance

Stricter global emissions regulations push carriers to modernize fleets quickly or face penalties—a costly compliance burden.

Opportunities in the Market

1. Green Shipping Technologies

Investments in eco‑friendly vessels and alternative fuels unlock opportunities for competitive advantage in a decarbonizing industry.

2. Digital Transformation

AI, IoT, and blockchain adoption in fleet and cargo management improve asset transparency and customer service.

3. Emerging Trade Routes

Diversification of manufacturing and consumption beyond traditional corridors (e.g., Asia‑Europe) into Africa and South America opens new container demand pockets.

4. Strategic M&A and Consolidation

Ongoing consolidation increases scale advantages:

-

CMA CGM and Stonepeak announced a nearly USD 10 billion port joint venture, strengthening terminal integration.

-

Major mergers among container leasing companies are reshaping fleet provision.

Top Players & Recent Developments (2025–2026)

Major Industry Players

-

MSC Mediterranean Shipping Company – World's largest container fleet with extensive capacity and new asset acquisitions.

-

AP Moller – Maersk – Strategic tech partnerships for AI fleet systems.

-

CMA CGM Group – Investing in LNG vessels and port infrastructure.

-

Hapag‑Lloyd AG – Engaged in strategic alliances and green fuel initiatives.

-

COSCO Shipping – Pioneering methanol bunkering and fleet expansion.

-

ZIM Integrated Shipping Services and other regional players expanding capacities.

Key Strategic Moves

-

CMA CGM – Stonepeak Port JV (~USD 10B) to enhance global terminal reach.

-

Gemini Alliance between Hapag‑Lloyd and Maersk for shared operations.

-

Leasing Industry Consolidation with major acquisitions reshaping container equipment ownership.

Impact of Current World Situation

Global trade is navigating post‑pandemic normalization, shifting supply chains, and geopolitical tensions. Capacity build‑ups versus demand recovery influence freight rates and fleet deployment strategies. Security incidents in key sea routes also impact routing decisions and insurance dynamics. The industry’s response to rising environmental mandates and technological disruption further defines competitive positioning.

Conclusion

The container fleet market in 2025–2026 is at a pivotal point—balancing capacity challenges with digital and green innovations. As carriers embrace sustainability, advanced analytics, and strategic alliances, the market is becoming more resilient and adaptable. Though overcapacity and geopolitical risks remain, opportunities in digitalization, alternative fuels, and emerging trade routes offer substantial growth pathways. Long‑term success hinges on fleet optimization, regulatory compliance, and value‑added services that improve end‑to‑end supply chain performance.

Most Asked Trending FAQs

1. What factors are driving container fleet growth?

Global trade expansion, diversification of manufacturing hubs, and investments in fleet modernization contribute to container fleet growth.

2. Is overcapacity a concern in container shipping?

Yes. A historically large orderbook and new vessel deliveries risk outpacing demand, which can pressure freight rates and utilization.

3. How is sustainability affecting the market?

Regulatory carbon targets and environmental goals are accelerating adoption of LNG, e‑fuels, and green vessels.

4. What role does technology play in fleet optimization?

AI, predictive maintenance, and real‑time tracking improve fleet efficiency, reduce downtime, and enhance cargo visibility.

5. Who are the top container fleet players?

Key players include MSC, Maersk, CMA CGM, COSCO Shipping, and Hapag‑Lloyd.

About Us:

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

- SEO

- Biografi

- Sanat

- Bilim

- Firma

- Teknoloji

- Eğitim

- Film

- Spor

- Yemek

- Oyun

- Botanik

- Sağlık

- Ev

- Finans

- Kariyer

- Tanıtım

- Diğer

- Eğlence

- Otomotiv

- E-Ticaret

- Spor

- Yazılım

- Haber

- Hobi