Personal Finance Software Market: Global Market Research Report and Industry Outlook

The Personal Finance Software Market is steadily expanding as individuals worldwide seek smarter tools to manage budgets, track expenses, plan investments, and improve overall financial well-being. Increasing digitalization of financial services, rising financial literacy, and the growing use of mobile and cloud-based applications are reshaping how consumers handle personal finances. This article presents a detailed, SEO-optimized analysis of the global personal finance software market, strictly based on insights from Straits Research.

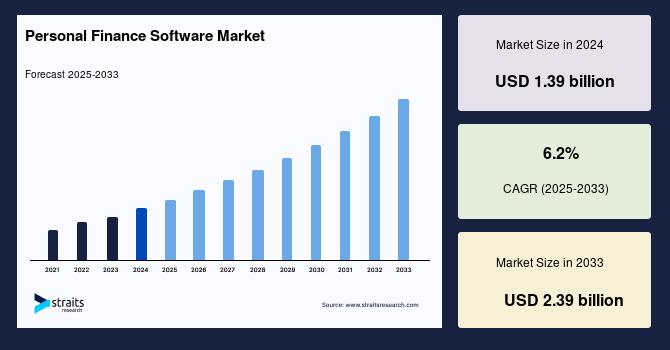

Market Size and Growth Outlook

The global personal finance software market size was valued at USD 1.39 billion in 2024 and is expected to grow from USD 1.48 billion in 2025 to reach USD 2.39 billion by 2033, growing at a CAGR of 6.2% during the forecast period (2025-2033).

The market’s consistent growth reflects increasing adoption of digital financial tools, growing awareness of financial planning, and rising demand for real-time visibility into personal spending and savings.

Get Your Sample Report Here: https://straitsresearch.com/report/personal-finance-software-market/request-sample

Buy Report Now: https://straitsresearch.com/buy-now/personal-finance-software-market

Download Full Report: https://straitsresearch.com/report/personal-finance-software-market

Market Drivers

Rising Financial Awareness and Budget Management Needs

Consumers are becoming more conscious of personal budgeting, savings, and debt management. Personal finance software enables users to track income and expenses, set financial goals, and monitor cash flow, driving widespread adoption across diverse income groups.

Growth of Mobile and Cloud-Based Financial Applications

The rapid penetration of smartphones and cloud computing has significantly boosted demand for mobile-based personal finance solutions. Cloud-enabled platforms offer real-time data access, automated updates, and seamless integration with bank accounts and payment systems, enhancing user convenience.

Increasing Adoption of Digital Banking and Fintech Solutions

The expansion of digital banking and fintech ecosystems is supporting the growth of personal finance software. Integration with digital wallets, online banking platforms, and investment tools enables users to manage multiple financial activities from a single interface.

Market Challenges

Data Security and Privacy Concerns

Personal finance software handles sensitive financial and personal data, making cybersecurity a critical concern. Data breaches, unauthorized access, and privacy issues can reduce consumer trust and limit adoption, particularly among risk-averse users.

Limited Financial Literacy in Emerging Markets

Despite growing awareness, limited financial literacy in certain regions restricts effective use of personal finance software. Users may struggle to fully utilize advanced features such as investment tracking and long-term financial planning.

Market Segmentation Analysis

By Deployment Mode

Cloud-based personal finance software dominates the market due to ease of access, scalability, and lower upfront costs. On-premise solutions are used by a smaller segment of users who prioritize data control and offline accessibility.

By Platform

Mobile platforms represent a major share of the market, driven by widespread smartphone adoption and demand for on-the-go financial management. Desktop-based solutions continue to be used by consumers seeking detailed financial analysis and long-term planning tools.

By Application

Budgeting and expense tracking account for a significant share of the market, as users prioritize daily financial monitoring. Investment management applications are growing steadily, supported by increasing participation in equity markets and digital investment platforms. Other applications include bill management, tax planning, and retirement planning.

By End User

Individual consumers form the largest end-user segment, driven by the need for personal financial control and planning. Self-employed professionals and freelancers are increasingly adopting personal finance software to manage irregular income, taxes, and savings more effectively.

Top Players Analysis

-

Intuit

Intuit is a leading player in the personal finance software market, offering solutions that support budgeting, expense tracking, and financial planning. Its strong brand recognition and user-friendly interfaces contribute to widespread adoption. -

Quicken

Quicken provides comprehensive personal finance management tools, including budgeting, bill management, and investment tracking. The company’s long-standing presence in the market supports consumer trust and loyalty. -

YNAB

YNAB focuses on proactive budgeting and financial discipline. Its methodology-driven approach appeals to users seeking structured financial planning and debt reduction. -

Moneydance

Moneydance offers cross-platform personal finance solutions with strong capabilities in budgeting and investment tracking. Its emphasis on simplicity and data control supports steady adoption. -

PocketSmith

PocketSmith provides forecasting-focused personal finance tools that help users plan long-term financial goals. Its scenario planning features differentiate it within the competitive landscape.

Frequently Asked Questions (FAQs)

What is personal finance software?

Personal finance software is a digital tool that helps individuals manage budgeting, expenses, savings, investments, and overall financial planning.

What factors are driving the personal finance software market?

Key drivers include rising financial awareness, growth of mobile and cloud-based applications, and increasing adoption of digital banking solutions.

Which platform dominates the market?

Mobile-based personal finance software dominates due to ease of access and growing smartphone usage.

How fast is the personal finance software market growing?

The market is expected to grow at a CAGR of 6.2% during the forecast period from 2025 to 2033.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

- SEO

- Biografi

- Sanat

- Bilim

- Firma

- Teknoloji

- Eğitim

- Film

- Spor

- Yemek

- Oyun

- Botanik

- Sağlık

- Ev

- Finans

- Kariyer

- Tanıtım

- Diğer

- Eğlence

- Otomotiv

- E-Ticaret

- Spor

- Yazılım

- Haber

- Hobi