Battery Contract Manufacturing Market Outlook 2035 Driving Efficiency Across Battery Supply Chains

As the world accelerates toward electrification, batteries have become the core enabler of modern mobility, renewable energy integration, and digital infrastructure. While much attention is placed on electric vehicles and energy storage systems, a critical pillar supporting this transition is battery contract manufacturing. By enabling scalability, cost optimization, and rapid innovation, contract manufacturers are playing a decisive role in meeting surging global battery demand. Looking ahead, the battery contract manufacturing market is set for strong and sustained growth through 2035.

Market Overview: Scaling Battery Production for a High-Demand Future

The global battery contract manufacturing market was valued at US$ 5.4 billion in 2024 and is projected to reach US$ 21.1 billion by 2035, expanding at a robust CAGR of 15.3% from 2025 to 2035. This growth reflects the rising reliance of OEMs and energy companies on specialized third-party manufacturers to meet increasing production volumes without heavy capital investments.

Market expansion is primarily driven by the rapid growth of electric vehicles (EVs) and the integration of renewable energy systems. As battery technologies evolve and demand becomes more diversified, contract manufacturing offers flexibility, speed, and technical expertise that in-house production often struggles to match.

Get Sample Copy of this report- https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86881

Battery Contract Manufacturing Market Size & Key Highlights

The battery contract manufacturing market reached US$ 5.4 billion in 2024, signaling growing outsourcing trends across the battery value chain. By 2035, the market is expected to climb to US$ 21.1 billion, highlighting the long-term importance of contract manufacturing in the global energy transition.

The industry is anticipated to expand at a CAGR of 15.3% between 2025 and 2035, making it one of the fastest-growing segments within the battery ecosystem. Asia Pacific dominated the market in 2024, accounting for 48% of global revenue, supported by strong manufacturing infrastructure and proximity to raw material supply chains.

By battery type, lithium-ion batteries held the largest market share at 42% in 2024, reflecting their widespread adoption across EVs, consumer electronics, and energy storage applications.

Key Growth Drivers Fueling Market Expansion

One of the primary drivers of the battery contract manufacturing market is the explosive growth of electric vehicles. Automakers are under intense pressure to scale battery production quickly while managing costs and supply chain risks. Contract manufacturers allow EV OEMs to accelerate production timelines, access advanced manufacturing capabilities, and reduce upfront capital expenditure.

Another major growth factor is the global push toward renewable energy integration. Energy storage systems are essential for balancing intermittent renewable sources such as solar and wind. As utilities and commercial players deploy large-scale battery storage projects, demand for high-quality, reliable battery manufacturing services is rising sharply.

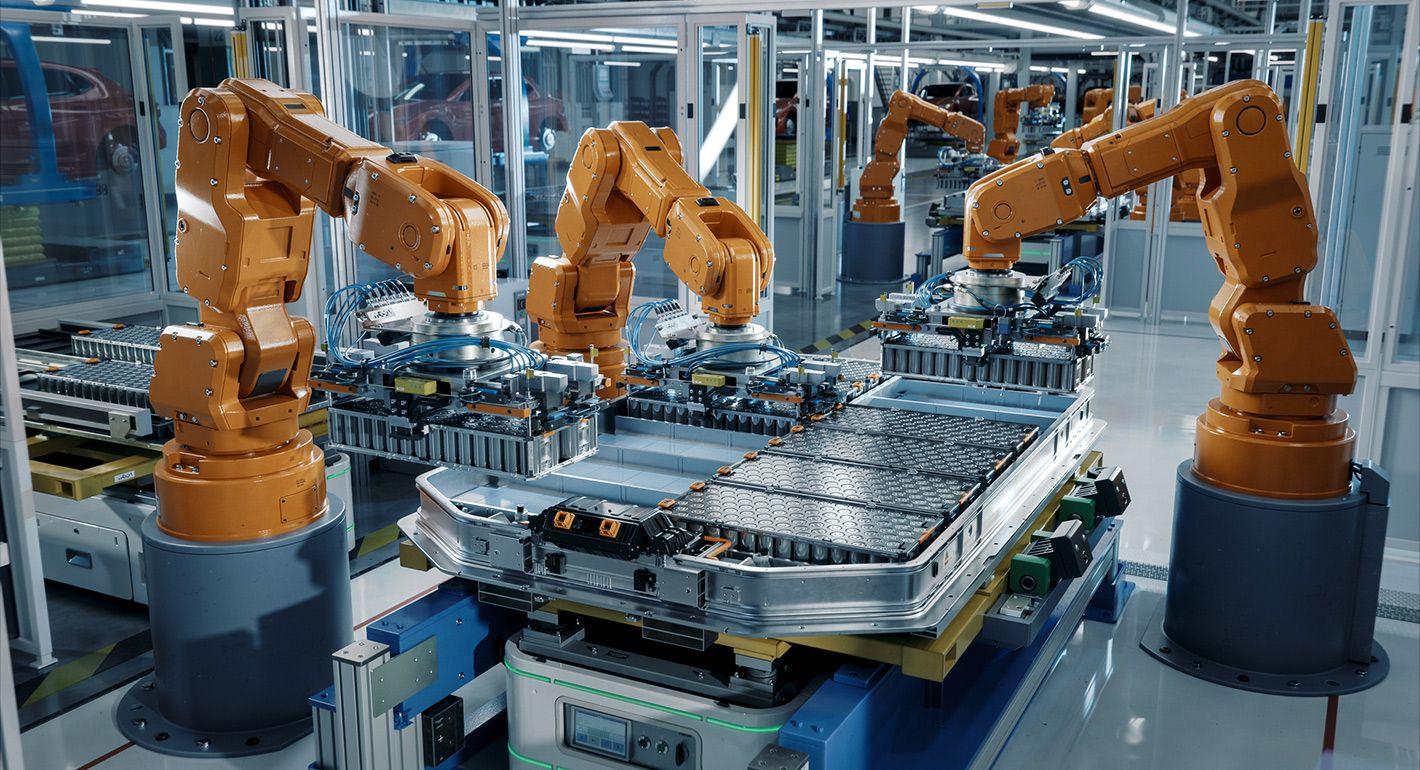

Additionally, increasing technological complexity in battery chemistries is driving outsourcing. Contract manufacturers invest heavily in automation, quality control, and process optimization, enabling them to deliver consistent performance across large volumes.

Lithium-ion Batteries Dominate Contract Manufacturing Demand

In 2024, lithium-ion batteries accounted for 42% of the battery contract manufacturing market, making them the dominant battery type. Their high energy density, long cycle life, and declining costs make them the preferred choice for EVs and stationary energy storage.

Contract manufacturers specializing in lithium-ion batteries are benefiting from continuous innovation in cell design, thermal management, and safety features. As next-generation chemistries such as solid-state and lithium iron phosphate (LFP) gain traction, contract manufacturers are expected to play a critical role in scaling these technologies commercially.

Technology Trends Reshaping Battery Contract Manufacturing

The battery contract manufacturing landscape is evolving rapidly, driven by automation, digitalization, and sustainability initiatives. Smart factories equipped with robotics, AI-driven quality inspection, and real-time monitoring systems are improving production efficiency and reducing defect rates.

Sustainability is also becoming a key differentiator. Contract manufacturers are investing in energy-efficient processes, waste reduction, and battery recycling capabilities to align with environmental regulations and OEM sustainability goals.

Customization is another growing trend. OEMs increasingly demand tailored battery solutions optimized for specific applications, pushing contract manufacturers to offer flexible production lines and modular manufacturing approaches.

Regional Insights: Asia Pacific Leads Global Manufacturing

Asia Pacific emerged as the leading region in 2024, holding 48% of global battery contract manufacturing revenue. Countries such as China, South Korea, and Japan dominate due to their advanced battery ecosystems, skilled workforce, and strong government support for EV and energy storage industries.

China, in particular, benefits from vertical integration across raw materials, cell manufacturing, and pack assembly. South Korea and Japan continue to lead in battery innovation and quality standards, serving both domestic and international OEMs.

Europe and North America are witnessing rapid growth as governments encourage localized battery production to reduce supply chain dependencies and support domestic EV industries.

Competitive Landscape: Strategic Scale and Technological Expertise

The battery contract manufacturing market is highly competitive, with players focusing on scale, reliability, and technological expertise. Major companies operating in the market include IONCOR, CATL, Rose Batteries, and LG Energy Solutions.

These companies leverage advanced manufacturing capabilities, strong R&D investments, and long-term partnerships with OEMs to maintain their market positions. Strategic expansions, joint ventures, and long-term supply agreements are common as manufacturers seek to secure future demand.

Challenges and Emerging Opportunities

Despite strong growth prospects, the market faces challenges such as raw material price volatility, supply chain disruptions, and stringent safety regulations. However, these challenges are driving innovation in alternative chemistries, recycling, and localized production models.

Emerging opportunities are particularly strong in battery manufacturing for energy storage systems, commercial EV fleets, and second-life battery applications, where demand is expected to rise significantly over the next decade.

Future Outlook: Contract Manufacturing as a Strategic Necessity

By 2035, battery contract manufacturing will no longer be a tactical outsourcing option—it will be a strategic necessity for companies operating in the EV and energy storage markets. As demand scales and technologies evolve, contract manufacturers will serve as the backbone of global battery supply chains.

The battery contract manufacturing market is set to play a pivotal role in powering the world’s transition toward electrification and sustainable energy.

- SEO

- Biografi

- Sanat

- Bilim

- Firma

- Teknoloji

- Eğitim

- Film

- Spor

- Yemek

- Oyun

- Botanik

- Sağlık

- Ev

- Finans

- Kariyer

- Tanıtım

- Diğer

- Eğlence

- Otomotiv

- E-Ticaret

- Spor

- Yazılım

- Haber

- Hobi