Offshore Mooring Systems Market: Industry Overview, Trends, and Future Outlook

The Offshore Mooring Systems Market is a vital segment of the global offshore energy and marine infrastructure industry. Mooring systems are engineered solutions that anchor floating structures—such as offshore oil and gas platforms, floating wind turbines, FPSOs (Floating Production, Storage, and Offloading units), and other maritime installations—to the seabed. Designed to ensure stability, safety, and longevity in harsh marine environments, these systems combine mechanical, material, and digital technologies to withstand winds, currents, and waves.

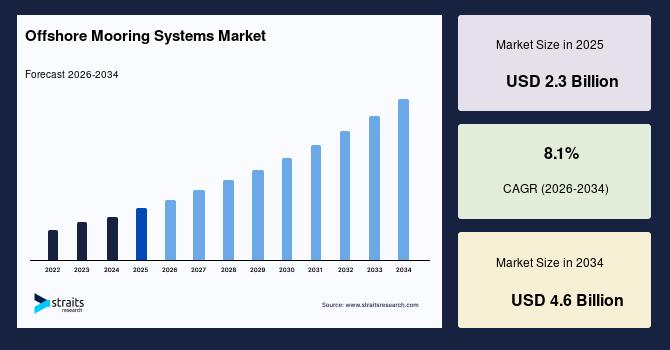

According to the latest Straits Research analysis, the global offshore mooring systems market was valued at approximately USD 2.3 billion in 2025 and is projected to reach USD 4.6 billion by 2034, expanding at a strong CAGR of 8.1% during 2026–2034.

Request a Sample Report and Explore the Valuable Insights @ https://straitsresearch.com/report/offshore-mooring-systems-market

Market Overview

Offshore mooring systems play an indispensable role in deepwater and ultra-deepwater offshore activities. They are essential for anchoring floating platforms, supporting safe operations in the oil & gas industry and increasingly in the renewable energy sector. The demand for advanced mooring solutions is driven by several key factors:

-

Expansion of deepwater oil & gas exploration requiring robust systems that can maintain position and safety under extreme conditions.

-

Growth of offshore renewable energy, particularly floating wind farms and wave energy installations, which depend on reliable mooring systems to maintain structural balance in deeper waters.

-

Shift from conventional steel mooring lines to lightweight, corrosion-resistant synthetic rope systems that improve performance and reduce maintenance costs.

Market Restraints

Despite promising growth prospects, the market faces several challenges:

Complex and Custom Design Requirements

Mooring systems must be specifically engineered for each project based on site conditions such as seabed composition, water depth, and environmental loads. This customization increases design time and cost, restricting wider adoption in some emerging offshore markets.

High Capital and Operational Expenditure

Installation and maintenance of mooring systems require significant investment. High material costs, combined with logistics and specialized installation vessels, can pressure project economics, especially in regions with limited offshore infrastructure.

Regulatory Compliance and Environmental Standards

Strict safety and environmental norms—such as those enforced by bodies like the Bureau of Safety and Environmental Enforcement (BSEE, US) and the European Maritime Safety Agency (EMSA)—require rigorous adherence to structural and ecological requirements, sometimes delaying project deployments.

Get Detailed Market Segmentation @ https://straitsresearch.com/report/offshore-mooring-systems-market/request-sample

Opportunities Ahead

The offshore mooring systems market presents several avenues for future growth:

Digital and IoT-Enabled Mooring Solutions

The integration of IoT sensors and predictive analytics into mooring systems allows real-time monitoring of line tension, fatigue life, and environmental loads. This digital transformation can significantly reduce unplanned downtimes and extend service life, unlocking new service-based revenue models.

Renewable Energy Momentum

With global commitments to lower carbon emissions, floating offshore wind and wave energy projects are gaining momentum. These applications require advanced, lightweight mooring solutions tailored for deepwater conditions, offering a high-growth segment beyond traditional oil and gas.

Emerging Markets

Asia Pacific is expected to be the fastest-growing region, propelled by offshore exploration across the South China Sea and Indian Ocean, along with expanding renewable energy deployments.

Market Segmentation

The Straits Research report segments the market by type, application, and region:

By Type

-

Chain Mooring Systems: Dominant segment in 2025 driven by long-term stability requirements in deepwater oil & gas platforms.

-

Synthetic Rope Mooring Systems: Fastest growing type due to lightweight and corrosion-resistant properties.

By Application

-

Oil & Gas Applications: Accounted for more than 50% of revenue in 2025 due to widespread use on platforms and drilling rigs.

-

Offshore Renewable Energy: High growth potential driven by floating wind and wave energy deployment.

By Region

-

North America: Held a 34% share in 2025, supported by extensive offshore infrastructure, especially in the Gulf of Mexico.

-

Europe, Asia Pacific, Middle East & Africa, Latin America: Each region offering unique growth dynamics with renewable energy and deepwater developments.

Key Players and Revenue Landscape

The offshore mooring systems market is moderately fragmented, with key multinational and regional players providing mooring design, manufacture, and services. Major participants include:

-

SBM Offshore N.V. – A global leader in FPSO and mooring solutions.

-

MODEC, Inc. – Specialist in floating production and mooring engineering.

-

BW Offshore Limited – Offers integrated offshore production and mooring services.

-

Delmar Systems, Inc. – Known for innovative mooring execution and project delivery.

-

Mampaey Offshore Industries – Supplies advanced mooring chains and systems.

-

Trelleborg Marine & Infrastructure – Develops polymer-based mooring solutions.

-

Bluewater Energy Services, NOV Inc., Cavotec SA, and others.

Latest Developments & Collaborations

Several noteworthy developments highlight the innovation landscape in the industry:

-

Delmar Systems was selected to deliver the mooring scope for the Culzean Floating Wind Pilot Project in the North Sea (2026).

-

Encorma achieved certification for its simplified floating wind mooring system.

-

SBM Offshore N.V., in collaboration with SLB and Cognite, advanced digital asset management for FPSO operations.

-

InterMoor and Jumbo Offshore formed a strategic alliance for comprehensive mooring engineering and installation services.

Frequently Asked Questions

Q1: What will be the market size in 2026?

The offshore mooring systems market is estimated at around USD 2.8 billion in 2026.

Q2: Which region holds the largest market share?

North America accounted for the maximum share of approximately 34% in 2025.

Q3: Which segment dominates by application?

Oil & gas remains the leading segment with over half of the total revenue in 2025.

Q4: What are key opportunities in the market?

Integration of IoT-based and predictive mooring solutions present new growth avenues.

Purchase Exclusive Premium Reports Now @ https://straitsresearch.com/buy-now/offshore-mooring-systems-market

Thanks for reading this article; you can also get separate chapter-wise sections or region-wise report versions like North America, Europe, or Asia.

About Us:

Straits Research is a leading research and intelligence organisation, specialising in research, analytics, and advisory services, along with providing business insights & research reports.

Contact Us:

Email: sales@straitsresearch.com

Tel: +1 646 905 0080 (U.S.), +44 203 695 0070 (U.K.)

- SEO

- Biografi

- Sanat

- Bilim

- Firma

- Teknoloji

- Eğitim

- Film

- Spor

- Yemek

- Oyun

- Botanik

- Sağlık

- Ev

- Finans

- Kariyer

- Tanıtım

- Diğer

- Eğlence

- Otomotiv

- E-Ticaret

- Spor

- Yazılım

- Haber

- Hobi