Construction Equipment Rental Market: Global Market Research Report and Industry Analysis

The construction equipment rental market has become a vital pillar of the global construction ecosystem, offering cost-effective and flexible access to heavy machinery without the burden of ownership. Construction equipment rental enables contractors, infrastructure developers, and industrial users to deploy modern equipment for short- and long-term projects while reducing capital expenditure and maintenance costs. According to Straits Research, the market is witnessing steady growth driven by rising infrastructure investments, urbanization, and the increasing preference for rental solutions over outright purchases.

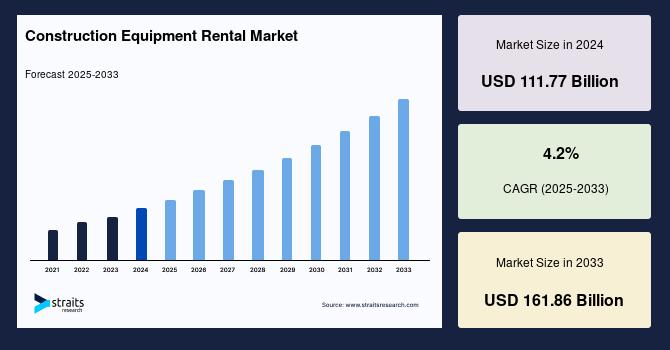

Market Size 2024 – USD 111.77 Billion · Market Size 2025 – USD 116.46 Billion · Market Size 2033 – USD 161.86 Billion · CAGR (2025–2033) – 4.2%

Get Your Sample Report Here: https://straitsresearch.com/report/construction-equipment-rental-market/request-sample

Buy Report Now: https://straitsresearch.com/buy-now/construction-equipment-rental-market

Download full report: https://straitsresearch.com/report/construction-equipment-rental-market

Market Overview

Construction equipment rental involves leasing machinery such as earthmoving equipment, material handling equipment, concrete and road construction machinery, and power solutions to contractors and end users. Straits Research indicates that the global construction equipment rental market size was valued at USD 111.77 billion in 2024 and is expected to expand steadily through 2033, supported by large-scale infrastructure projects and increasing construction activity across both developed and emerging economies.

The rental model allows companies to access advanced and technologically upgraded equipment while avoiding depreciation risks and high upfront investments. This has made rental services particularly attractive for small and medium-sized contractors, as well as for large infrastructure projects requiring specialized machinery for limited durations.

Market Drivers and Challenges

Key Market Drivers

Rising infrastructure development and urbanization

Government-led investments in transportation networks, smart cities, residential housing, and energy infrastructure are significantly boosting demand for construction equipment. Rental services are preferred for these projects due to their flexibility and scalability.

Cost efficiency and reduced capital expenditure

Renting construction equipment eliminates the need for large capital investments, long-term maintenance, and storage costs. This financial advantage is a major driver encouraging contractors to shift from ownership to rental models.

Growing adoption of advanced construction technologies

Modern construction projects increasingly require technologically advanced machinery equipped with telematics, automation, and fuel-efficient systems. Renting enables contractors to access the latest equipment without frequent replacement costs.

Market Challenges

Equipment availability and utilization risks

During periods of high construction activity, limited availability of rental equipment can lead to project delays. Rental companies must maintain optimal fleet utilization to meet fluctuating demand.

Maintenance and operational challenges

Ensuring timely maintenance and operational reliability of rental fleets is critical. Equipment downtime can affect customer satisfaction and rental company profitability.

Market Segmentation Analysis

By Equipment Type

The construction equipment rental market is segmented into earthmoving equipment, material handling equipment, concrete and road construction equipment, and others. Earthmoving equipment, including excavators, loaders, and bulldozers, holds a significant share due to its extensive use in infrastructure and mining projects. Material handling equipment such as cranes and forklifts is also witnessing strong demand, driven by urban construction and industrial expansion.

By Application

Residential construction

Residential construction represents a key application segment, supported by increasing housing demand and urban population growth. Rental equipment is widely used for short-term residential projects and renovation activities.

Commercial construction

Commercial construction includes office buildings, retail complexes, and mixed-use developments. Rental solutions provide flexibility for contractors managing diverse project requirements.

Infrastructure and industrial construction

Infrastructure and industrial projects, including highways, bridges, airports, and power plants, account for a substantial share of rental demand due to the need for heavy-duty and specialized machinery.

By Rental Duration

The market is categorized into short-term and long-term rentals. Short-term rentals are commonly used for repair, maintenance, and small-scale projects, while long-term rentals dominate large infrastructure and industrial developments.

By End User

End users include construction contractors, infrastructure developers, industrial enterprises, and government agencies. Construction contractors represent the largest end-user segment due to continuous demand for diverse equipment across multiple projects.

By Region

North America dominates the construction equipment rental market, supported by mature construction industries, strong infrastructure spending, and widespread acceptance of rental models. Europe follows, driven by urban redevelopment and infrastructure modernization projects. Asia-Pacific is expected to witness the fastest growth due to rapid urbanization, increasing construction activity, and government investments in emerging economies such as China and India.

Top Players Analysis

According to Straits Research, the construction equipment rental market is moderately consolidated, with leading players focusing on fleet expansion, digital platforms, and customer-centric services.

-

United Rentals, Inc.

United Rentals is a leading global player offering a comprehensive range of construction and industrial equipment rental solutions. Its extensive fleet and strong geographic presence support market leadership. -

Ashtead Group plc

Ashtead Group operates through its Sunbelt Rentals brand, providing construction and industrial equipment rental services across North America and Europe, with a focus on service quality and fleet diversification. -

Herc Rentals Inc.

Herc Rentals offers a wide portfolio of earthmoving, material handling, and specialty equipment, catering to construction, industrial, and government clients. -

Loxam Group

Loxam is a major rental provider in Europe, offering construction and industrial equipment rental services with a strong focus on sustainability and fleet modernization. -

Boels Rental

Boels Rental serves a broad customer base across Europe, providing construction equipment rental solutions supported by a growing international footprint.

Related FAQs

What is construction equipment rental?

Construction equipment rental involves leasing machinery for temporary use in construction, infrastructure, and industrial projects instead of purchasing equipment outright.

Why is the construction equipment rental market growing?

The market is growing due to rising infrastructure investments, cost efficiency of rental models, and increasing demand for advanced construction equipment.

Which region leads the construction equipment rental market?

North America leads the market, while Asia-Pacific is expected to experience the fastest growth.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

- SEO

- Biografi

- Sanat

- Bilim

- Firma

- Teknoloji

- Eğitim

- Film

- Spor

- Yemek

- Oyun

- Botanik

- Sağlık

- Ev

- Finans

- Kariyer

- Tanıtım

- Diğer

- Eğlence

- Otomotiv

- E-Ticaret

- Spor

- Yazılım

- Haber

- Hobi