Legalized Cannabis Market: Trends, Challenges & Opportunities (2025–26)

The global legalized cannabis market has evolved rapidly over the past decade, transitioning from niche and illicit roots into a formidable multibillion‑dollar industry. Fueled by shifting public attitudes, evolving regulations, scientific research, and expanding commercial applications, cannabis markets are now transforming sectors from wellness and pharmaceuticals to e‑commerce and agritech. As of 2026, the industry stands at a crossroads of opportunity and challenge, shaped by regulatory dynamics, economic headwinds, and innovation.

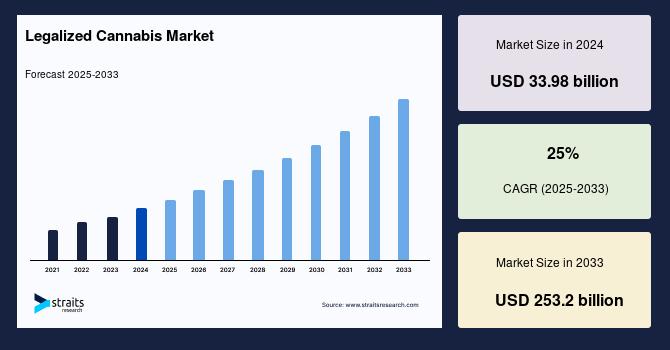

Market Overview & Size

The global legal cannabis market was estimated at USD ~42 billion in 2025 and projected to grow to ~USD 52 billion in 2026, with long‑term forecasts anticipating expansion to ~USD 283 billion by 2035 at a CAGR exceeding 20 % from 2026–35.

Get Your Sample Report Here:https://straitsresearch.com/report/legalized-cannabis-market

Buy Report Now:https://straitsresearch.com/report/legalized-cannabis-market/request-sample

Download full report:https://straitsresearch.com/buy-now/legalized-cannabis-market

Segments in the Cannabis Market

The market is typically segmented as follows:

-

By Product Type

-

Buds / Flower: Dominant in traditional cannabis sales.

-

Edibles & Beverages: Growing rapidly as consumer preference shifts toward discreet and functional formats.

-

Oils / Tinctures / Concentrates: Popular in medicinal and wellness applications.

-

CBD & Hemp Products: Massive growth in wellness, cosmetics, and industrial applications.

-

-

By Application

-

Medical Cannabis: Largest revenue share, driven by chronic pain, anxiety, and neurological conditions.

-

Recreational Use: Growing where legal, but faces regulatory and age‑restriction hurdles.

-

Wellness & Cosmetics: A key emerging opportunity as consumers adopt CBD for health and skincare.

-

-

By Distribution Channel

-

Retail Stores: Still the backbone in established markets like North America and Canada.

-

E‑Commerce / DTC: Rising sharply with home delivery and subscription models.

-

-

By Region

-

North America: Continues to lead market share but is held back by federal legal fragmentation.

-

Europe & LATAM: Emerging as rapid growth regions thanks to new regulatory frameworks.

-

Other Markets: Africa and Asia Pacific are beginning regulatory reforms and cultivation expansion.

-

Latest Market Trends

1. Product Diversification & Consumer Preferences

Consumers are shifting away from traditional flower products toward edibles, oils, tinctures, low‑THC functional products, and cannabis‑infused beverages. This diversification is driven by wellness trends and demand for discreet consumption options.

2. Wellness & Medicinal Focus

Cannabis is increasingly recognized for therapeutic use—especially chronic pain, anxiety, sleep disorders, and neurological conditions. Products that combine CBD with other cannabinoids or botanicals are expanding mainstream appeal.

3. E‑Commerce & Direct‑to‑Consumer Channels

Online sales and app‑based delivery platforms have become key growth drivers, especially in markets with strong tourism or limited physical retail access.

4. Sustainable & Tech‑Driven Cultivation

Innovations like hydroponics, vertical farming, controlled environment agriculture (CEA), and automation are improving yields, quality, and sustainability. Eco‑friendly packaging and carbon‑neutral brands are increasingly valued.

5. Global Export & Emerging Markets

Countries like Morocco, with legal cultivation initiatives, aim to supply Europe and beyond, transforming historic illicit markets into regulated economies.

Key Challenges Facing the Market

Regulatory & Legal Fragmentation

Despite progress, inconsistent cannabis laws across regions create complex compliance landscapes. In the U.S., federal illegality continues to limit interstate commerce, banking access, and tax advantages.

Recent U.S. regulatory shifts—such as federal efforts to reschedule cannabis from Schedule I to III—are promising but fall short of full legalization, leaving banks cautious.

Black Market Competition

Illegal markets continue to undercut legal prices due to the lack of taxation and regulatory costs, squeezing margins for legitimate operators.

Banking & Capital Access

Cannabis businesses struggle to access traditional banking services, forcing reliance on alternative lenders with higher costs.

Supply Chain & Quality Consistency

Securing consistent raw materials and ensuring precise THC/CBD content remain operational challenges, especially with varying regional standards.

Opportunities in the Cannabis Market

Wellness & CBD Expansion

Cannabis‑based wellness products—especially CBD oils and topicals—are attracting older demographics seeking alternatives to traditional pharmaceuticals.

Medical Research & Pharmaceuticals

As clinical research expands, cannabis derivatives are entering mainstream medicine, presenting large future potentials for prescription cannabis therapies.

International Legalization

Regions such as Europe, Latin America, and Africa are expanding legal frameworks. Germany, for example, continues to lead Europe with legal clubs and growth strategies.

Top Players & Recent Developments (2025–26)

Canopy Growth Corporation

Canopy has expanded into CBD cosmetics and international markets, leveraging acquisitions to diversify product lines.

Curaleaf Holdings

In early 2025, Curaleaf announced strategic European partnerships to build compliant supply chains and accelerate patient access.

Trulieve Cannabis Corp

Launched a nationwide cannabis‑infused beverage line in Florida in 2025, a major move into value‑added products.

Organigram Global

Rebranded in 2025 and appointed a new CEO to spearhead global expansion.

M&A & Deals

Major market reshuffling continues, though headline mega‑deals are rare. Instead, structured and opportunistic transactions aimed at consolidating market share are more prevalent.

Recent deals include Scotts Miracle‑Gro selling its cannabis supply unit, Hawthorne Gardening, to Vireo Growth with strategic equity participation.

Impact of the Current World Situation

Economic Shifts & Regulation

Global economic uncertainty and diverse legal environments have influenced investment strategies. While some regions accelerate legalization and export strategies, others tighten regulations (e.g., U.S. crackdown on THC drinks).

Post‑Pandemic Demand Patterns

Post‑COVID consumption patterns show sustained demand for wellness and functional products rather than pure recreational use.

International Trade & Supply Chains

Export‑oriented legalization in countries like Morocco illustrates how global supply chains are evolving to reduce dependency on traditional markets.

Conclusion

The legalized cannabis market in 2025–26 stands at a pivotal moment: growth is robust and multifaceted, driven by consumer demand, medical acceptance, technological innovation, and global legalization trends. However, regulatory complexity, banking limitations, competition with illicit markets, and supply chain inconsistencies remain core challenges.

For investors and businesses, strategic diversification into wellness products, medical applications, e‑commerce platforms, and international operations presents significant opportunities. But success will require navigating fragmented regulatory environments and aligning with evolving global policy frameworks.

Frequently Asked Questions (FAQs)

Q1: What’s driving growth in the global cannabis market?

A: Increasing legalization, demand for medicinal and wellness products, product diversification (edibles, oils), and e‑commerce growth.

Q2: Which cannabis segment is growing fastest?

A: The CBD and wellness segment, followed by edibles and infused beverages.

Q3: Why is U.S. federal legalization important?

A: It would unlock banking access, interstate commerce, tax relief, and large institutional investment, removing major market barriers.

Q4: Are cannabis companies profitable?

A: Profitability varies; larger players with diversified portfolios and international reach tend to perform better.

Q5: How big will the cannabis market be by 2035?

A: Forecasts suggest a market exceeding USD 280 billion by 2035.

About Us:

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

- SEO

- Biografi

- Sanat

- Bilim

- Firma

- Teknoloji

- Eğitim

- Film

- Spor

- Yemek

- Oyun

- Botanik

- Sağlık

- Ev

- Finans

- Kariyer

- Tanıtım

- Diğer

- Eğlence

- Otomotiv

- E-Ticaret

- Spor

- Yazılım

- Haber

- Hobi